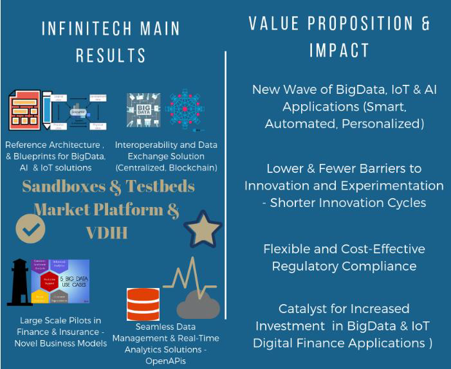

The project, which has received 16 million euros in European funds and brings together some of the largest banks in Europe with IoT and Big Data companies, started in October and will last 39 months. The aim is to develop new technological tools for the European finance and insurance ecosystem.

The INFINITECH project is part of the Horizon 2020 program, the largest R&D program launched by the European Union to date and is considered as a flagship initiative for Big Data and IoT in finance and insurance sector. The motivation of this project is to overcome todays boundaries derived mainly from the inadequate support for real-time AI use cases due to the limited available dataset for training the analytical algorithms in these verticals.LeanXcale will be the central element of the data architecture of this project, which involves 48 organizations from 16 different countries that will use LeanXcale as the central data repository.LeanXcale will additionally implement the streaming engine of the platform, which will enable the execution of parallel and incremental analytics combining data from different and heterogeneous sources.The project’s partners include among others the following financial organizations, major companies and research centers:GFT Italia, Atos Spain, IBM, Fujitsu, Hewlett Packard, Engineering, Santander, Liberbank, National Bank of Greece, Aktifbank, Bank of Slovenia, Bankia, Bank of Cyprusm Bank of Ireland, etc.

What will LeanXcale do in INFINITECH? LeanXcale makes a major contribution in INFINITECH by making its ultra-scalable transactional relational database the central data repository of the project, being able to serve both operational and analytical workloads over real data of the same dataset.

With the polyglot extensions of its query engine, the data repository can be considered as a poly-store database system that is capable of executing query statements in different data stores, inside or outside an INFINITECH sandbox, retrieving and joining the intermediate results at the level of the query engine, and returning them back to the data analyst, who uses standard data connectivity methods.

Moreover , LeanXcale is building the streaming engine of INFINITECH, based on Apache Flink, and extending its core in order to allow for operations over the data repository, thus enabling the execution of queries that correlate streaming data with data at rest. While implementing a query language and a compiler for context event processing, it also allows for automated parallelization of data streams at the same time, which can formulate intelligent data pipelining.

Being able to combine streaming data with data at rest stored in the data repository, LeanXcale will provide the corresponding enablers for incremental data analytics, thus giving the opportunity to the data analyst to execute a query and observe the results that are continuously updated in real-time, via the stream. Moreover, in the scope of the INFINITECH project, LeanXcale will parallelize popular analytics algorithms frequently used in the finance sector in order to boost their performance. Finally, it will extend the standard SQL dialect in order to provide declarative real-time data analytics using features of its storage engine such as live aggregations.

The contribution of LeanXcale to INFINITECH will be validated by 14 different pilots coming from various banks and finance or insurance institutions with a variety of different use cases. By combining streaming data with the parallel data analytics that LeanXcale provides, fraud transactions and money laundering operations can be detected on the run-time, which is crucial for financial institutions. Moreover, risk assessment will be more accurate by combining user- or business-related data from different data sources that can be either internal to the organization, or external such as social, demographic or behavior data. This will be enabled by exploiting the polyglot capabilities of LeanXcale that will be further developed in the scope of the project in order to support a variety of different types of data stores. Accurate risk assessment can benefit both financial institutions and their customers, as the former can provide personalized investment portfolio management for retail customers, and not only for investors with significant budgets, which is the norm nowadays.

By combining data from different and heterogeneous sources via LeanXcale’s polystore query engine, the goal is to create personalized information known KYC (know-your-costumer). This information will be further enhanced from static processes, with information derived from online customer behavior analytics and from regular customer interactions, exploiting the real-time data analytics of INFINITECH that are provided by LeanXcale. This will allow for the creation of more accurate profiling, which will improve the recommendation analytics of the sector, thus allowing for better and more personalized finance services or insurance products.

Through this project, LeanXcale aims to disrupt the finance and insurance sectors, enabling new use cases that wouldn’t be possible without LeanXcale technology.

WRITTEN BY

Pavlos Kranas

Software Engineer at LeanXcale

Pavlos Kranas is a senior software engineer from the School of Electrical and Computer Engineering, of the National Technical University of Athens. Pavlos brought to LeanXcale his solid background of distributed and database management systems and his experience in software development and project management, mainly gained while he was working for the Institute of Communication and Computer Systems (ICCS) of NTUA in Athens for 7 years.